On this page

The primary statements

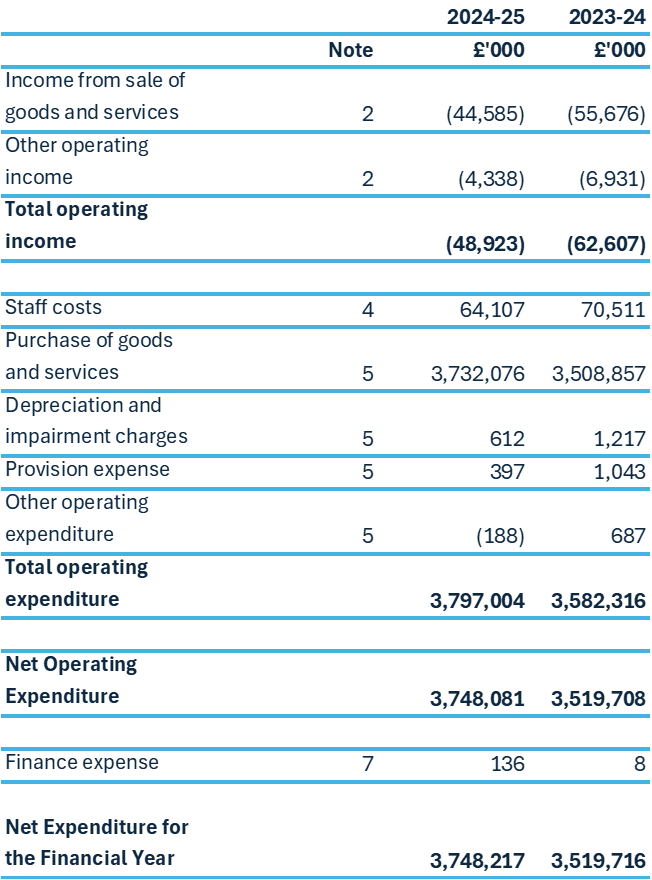

Statement of comprehensive net expenditure for the year ended 31st March 2025

Statement of financial position as at 31 March 2025

The notes below form part of this statement.

The financial statements on this page were approved by the Board on 18 June 2025 and signed on its behalf by:

Chief Accountable Officer

Katie Fisher

18 June 2025

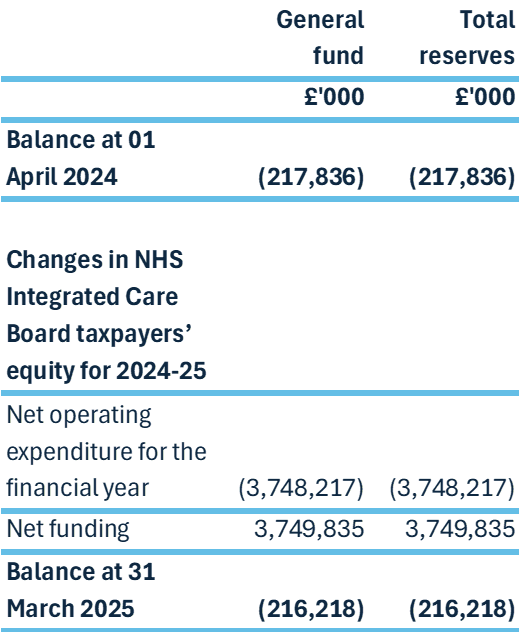

Statement of changes in taxpayers’ equity for the year ended

31 March 2025

Changes in taxpayers’ equity for 2024-25

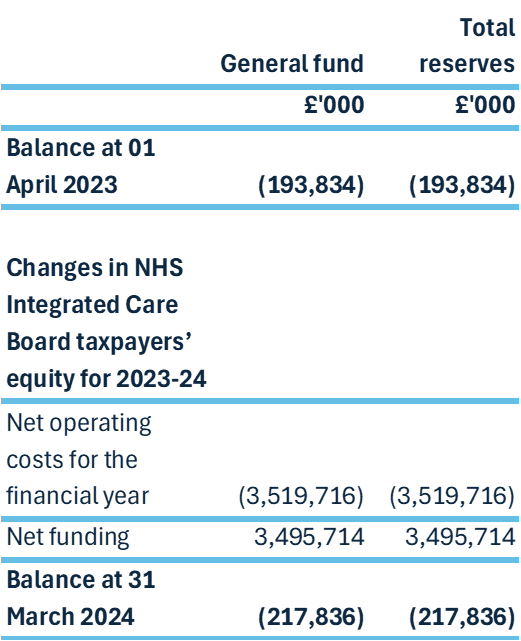

Changes in taxpayers’ equity for 2023-24

The notes below form part of this statement.

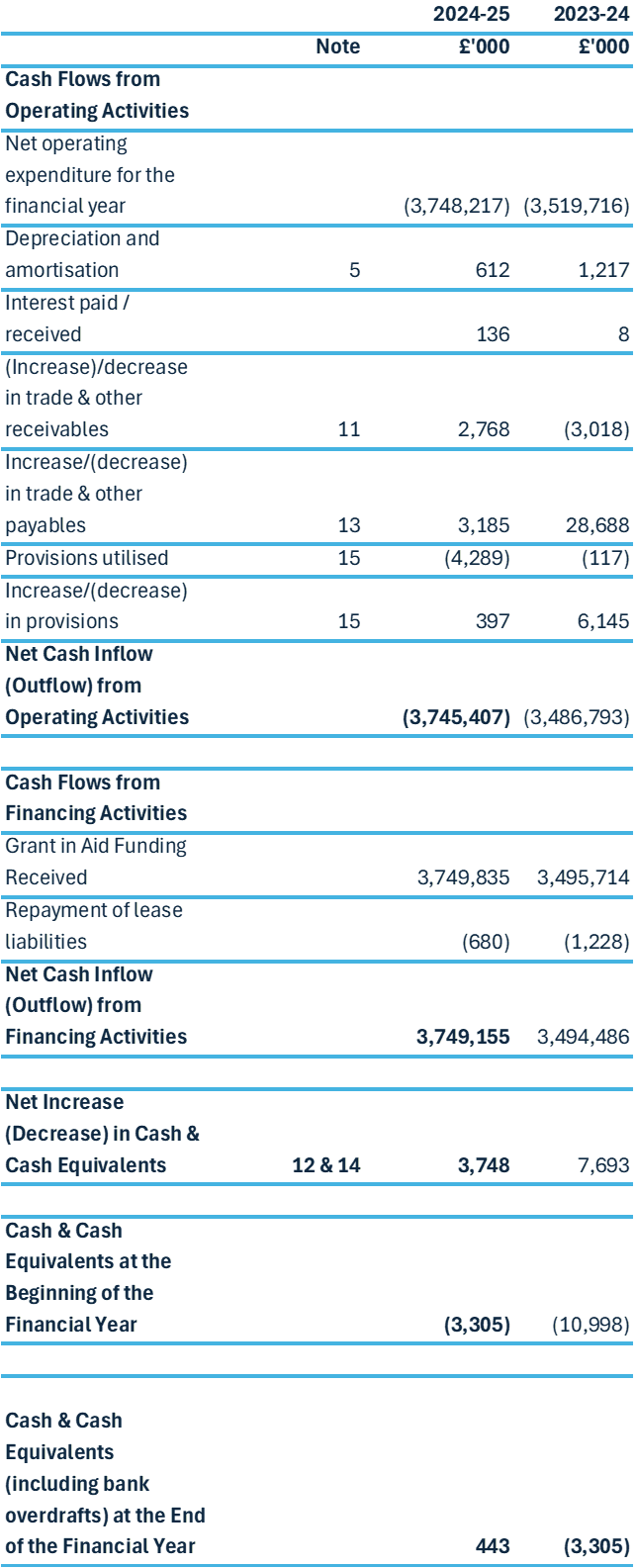

Statement of cash flows for the year ended 31 March 2025

The notes below form part of this statement.

Notes to the financial statements

1. Accounting policies

NHS England has directed that the financial statements of Integrated Care Boards (ICBS) shall meet the accounting requirements of the Group Accounting Manual issued by the Department of Health and Social Care. Consequently, the following financial statements have been prepared in accordance with the Group Accounting Manual 2024-25 issued by the Department of Health and Social Care. The accounting policies contained in the Group Accounting Manual follow International Financial Reporting Standards to the extent that they are meaningful and appropriate to Integrated Care Boards, as determined by HM Treasury, which is advised by the Financial Reporting Advisory Board.

Where the Group Accounting Manual permits a choice of accounting policy, the accounting policy which is judged to be most appropriate to the particular circumstances of the ICB for the purpose of giving a true and fair view has been selected. The particular policies adopted by the ICB are described below. They have been applied consistently in dealing with items considered material in relation to the accounts.

1.1 Going concern

On 13 March 2025 the government announced NHS England and the Department for Health and Social Care will increasingly merge functions, ultimately leading to NHS England being fully integrated into the Department. The legal status of ICBs is currently unchanged.

Public sector bodies are assumed to be going concerns where the continuation of the provision of a service in the future is anticipated. If services will continue to be provided in the public sector the financial statements should be prepared on the going concern basis. The statement of financial position has therefore been drawn up at 31 March 2025, on a going concern basis.

1.2 Accounting convention

These accounts have been prepared under the historical cost convention modified to account for the revaluation of property, plant and equipment, intangible assets, inventories and certain financial assets and financial liabilities.

1.3 Pooled budgets

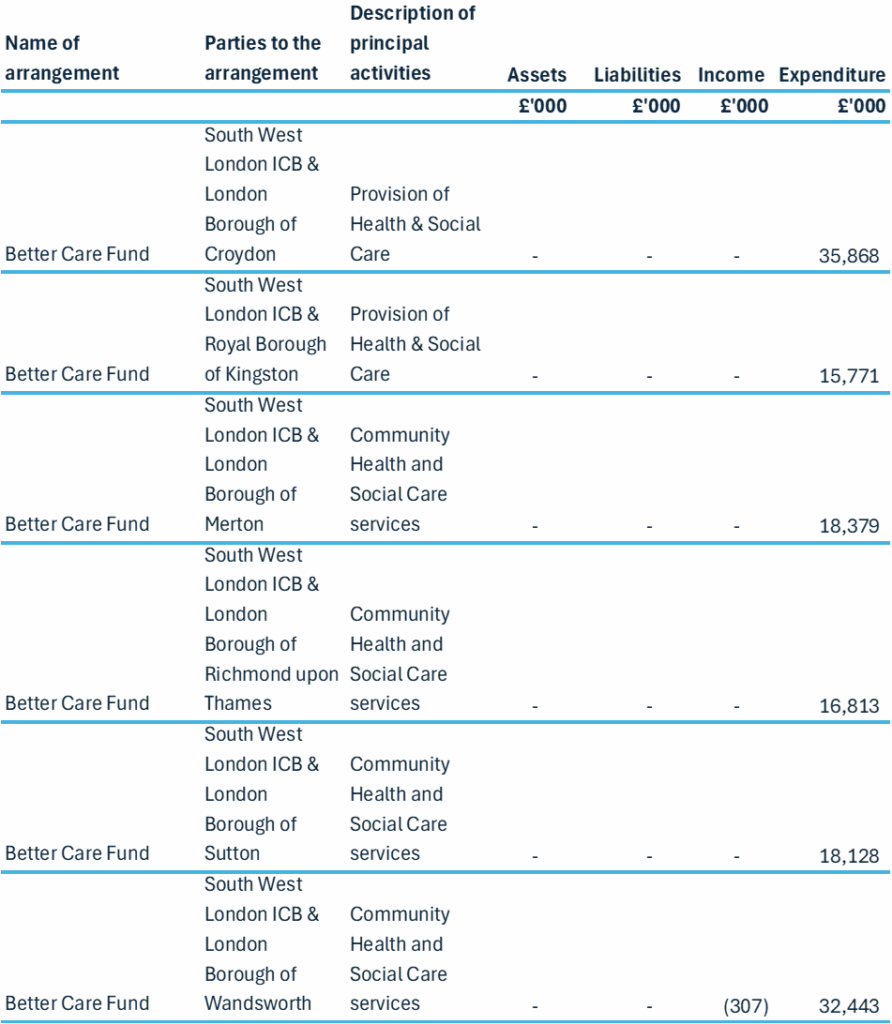

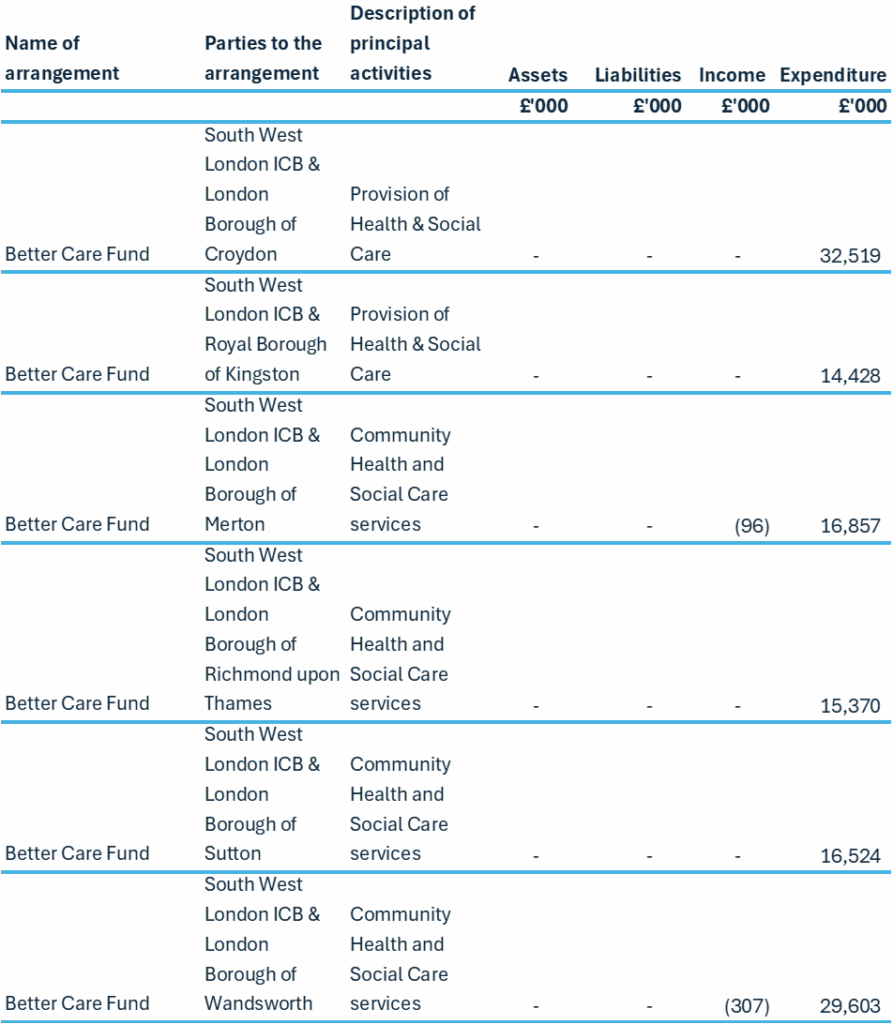

South West London ICB has entered into pooled budget arrangements under Section 75 of the National Health Service Act 2006 with 6 of the Local London Boroughs (Croydon, Kingston, Merton, Richmond, Sutton and Wandsworth), relating to the commissioning of health and social care services within the Better Care Fund. The ICB accounts for its share of the assets, liabilities, income and expenditure arising from t he activities of the pooled budget, identified in accordance with the pooled budget arrangement. The Section 75 agreements clearly sets out the accounting, risk share and governance arrangements.

The accountable bodies for the Better Care Fund are the Local Authorities who hold the funds apart from Croydon where the ICB holds the fund. They are managed through a joint management committee.

Section 75 of the NHS Act 2006 allows partners (NHS Bodies and Councils) to contribute to a common fund which can be used to commission health or social care related services. This power allows a local authority to commission health services and NHS Commissioners to commission social care.

1.4 Critical accounting judgements and key sources of estimation uncertainty

In the application of the ICB’s accounting policies, management is required to make judgements, estimates and assumptions about the carrying amounts of assets and liabilities that are not readily apparent from other sources. No critical accounting judgements were made in the year and where estimates were made, they had no material impact on the financial results of the ICB.

1.5 Operating segments

Income and expenditure are analysed in the Operating Segments note and are reported in line with management information used within the ICB.

1.6 Revenue

In the application of IFRS 15 a number of practical expedients offered in the Standard have been employed. These are as follows:

- As per paragraph 121 of the Standard, the ICB will not disclose information regarding performance obligations part of a contract that has an original expected duration of one year or less,

- The ICB is to similarly not disclose information where revenue is recognised in line with the practical expedient offered in paragraph B16 of the Standard where the right to consideration corresponds directly with value of the performance completed to date.

- The FReM has mandated the exercise of the practical expedient offered in C7(a) of the Standard that requires the ICB to reflect the aggregate effect of all contracts modified before the date of initial application.

The main source of funding for the ICBs is from NHS England. This is drawn down and credited to the general fund. Funding is recognised in the period in which it is received.

Revenue in respect of services provided is recognised when (or as) performance obligations are satisfied by transferring promised services to the customer, and is measured at the amount of the transaction price allocated to that performance obligation.

Where income is received for a specific performance obligation that is to be satisfied in the following year, that income is deferred.

Payment terms are standard reflecting cross government principles. Significant terms require that 95% of undisputed, valid invoices should be paid within 30 days.

1.7 Employee benefits

1.7.1 Short-term employee benefits

Salaries, wages and employment-related payments, including payments arising from the apprenticeship levy, are recognised in the period in which the service is received from employees, including bonuses earned but not yet taken.

The cost of leave earned but not taken by employees at the end of the period is recognised in the financial statements to the extent that employees are permitted to carry forward leave into the following period.

1.7.2 Retirement benefit costs

Past and present employees are covered by the provisions of the two NHS Pension Schemes. Details of the benefits payable and rules of the Schemes can be found on the NHS Pensions website at www.nhsbsa.nhs.uk/pensions. Both are unfunded defined benefit schemes that cover NHS employers, GP practices and other bodies, allowed under the direction of the Secretary of State for Health and Social Care in England and Wales. They are not designed to be run in a way that would enable NHS bodies to identify their share of the underlying scheme assets and liabilities.

Therefore, each scheme is accounted for as if it were a defined contribution scheme: the cost to the NHS body of participating in each scheme is taken as equal to the contributions payable to that scheme for the accounting period.

For early retirements other than those due to ill health the additional pension liabilities are not funded by the scheme. The full amount of the liability for the additional costs is charged to expenditure at the time the ICB commits itself to the retirement, regardless of the method of payment.

The schemes are subject to a full actuarial valuation every four years and an accounting valuation every year.

1.8 Other expenses

Expenditure on goods and services is recognised when, and to the extent that they have been received, and is measured at the fair value of those goods and services. Expenditure is recognised in operating expenses except where it results in the creation of a non-current asset such as property, plant and equipment.

1.9 Leases

A lease is a contract, or part of a contract, that conveys the right to control the use of an asset for a period of time in exchange for consideration. The ICB assesses whether a contract is or contains a lease, at inception of the contract.

1.9.1 The ICB as lessee

A right-of-use asset and a corresponding lease liability are recognised at commencement of the lease.

The lease liability is initially measured at the present value of the future lease payments, discounted by using the rate implicit in the lease. If this rate cannot be readily determined, the prescribed HM Treasury discount rates are used as the incremental borrowing rate to discount future lease payments.

The lease liability is subsequently measured by increasing the carrying amount for interest incurred using the effective interest method and decreasing the carrying amount to reflect the lease payments made. The lease liability is remeasured, with a corresponding adjustment to the right-of- use asset, to reflect any reassessment of or modification made to the lease.

The right-of-use asset is initially measured at an amount equal to the initial lease liability adjusted for any lease prepayments or incentives, initial direct costs or an estimate of any dismantling, removal or restoring costs relating to either restoring the location of the asset or restoring the underlying asset itself, unless costs are incurred to produce inventories.

The subsequent measurement of the right-of-use asset is consistent with the principles for subsequent measurement of property, plant and equipment. Accordingly, right-of-use assets that are held for their service potential and are in use are subsequently measured at their current value in existing use.

Right-of-use assets for leases that are low value or short term and for which current value in use is not expected to fluctuate significantly due to changes in market prices and conditions are valued at depreciated historical cost as a proxy for current value in existing use.

Other than leases for assets under construction and investment property, the right -of-use asset is subsequently depreciated on a straight-line basis over the shorter of the lease term or the useful life of the underlying asset. The right-of-use asset is tested for impairment if there are any indicators of impairment and impairment losses are accounted for as described in the ‘Depreciation, amortisation and impairments’ policy.

Leases of low value assets (value when new less than £5,000) and short-term leases of 12 months or less are recognised as an expense on a straight-line basis over the term of the lease.

1.10 Cash and cash equivalents

Cash is cash in hand and deposits with any financial institution repayable without penalty on notice of not more than 24 hours. Cash equivalents are investments that mature in 3 months or less from the date of acquisition and that are readily convertible to known amounts of cash with insignificant risk of change in value.

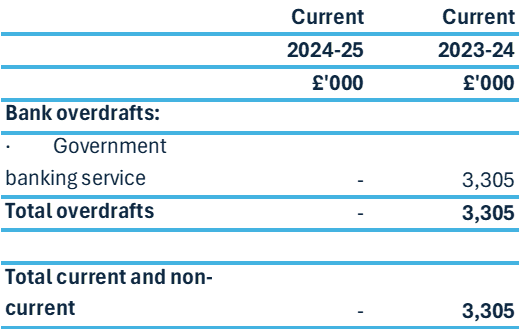

South West London ICB has no formal bank overdraft facilities or outstanding loans and is expected to maintain a positive cas h balance at the bank at all times. However, due to timing differences, it is possible for the bank account to be technically overdrawn on the last day of the month and this is reported as borrowings in note 14. This situation arises when supplier payments are made by BACS in the last 2 working days of the month and the actual bank balance at the time is lower than the value of the payment run. These circumstances arose in March 2024. Funding for the month is received from NHSE on the first working day of the following month (April), so funds are available when the BACS payments are cleared through the bank account on the same day.

In the Statement of Cash Flows, cash and cash equivalents are shown net of bank overdrafts that are repayable on demand and that form an integral

part of the ICB’s cash management.

1.11 Provisions

Provisions are recognised when the ICB has a present legal or constructive obligation as a result of a past event, it is probable that the ICB will be required to settle the obligation, and a reliable estimate can be made of the amount of the obligation. The amount recognised as a provision is the best estimate of the expenditure required to settle the obligation at the end of the reporting period, taking into account the risks and uncertainties. Where a provision is measured using the cash flows estimated to settle the obligation, its carrying amount is the present value of those cash flows using HM Treasury’s discount rate as follows:

All general provisions are subject to four separate discount rates according to the expected timing of cashflows from the Statement of Financial Position date:

- A nominal short-term rate of 4.03% (2023-24: 4.26%) for inflation adjusted expected cash flows up to and including 5 years from Statement of Financial Position date.

- A nominal medium-term rate of 4.07% (2023-24: 4.03%) for inflation adjusted expected cash flows over 5 years up to and including 10 years from the Statement of Financial Position date.

- A nominal long-term rate of 4.81% (2023-24: 4.72%) for inflation adjusted expected cash flows over 10 years and up to and including 40 years from the Statement of Financial Position date.

- A nominal very long-term rate of 4.55% (2023-24: 4.40%) for inflation adjusted expected cash flows exceeding 40 years from the Statement of Financial Position date.

When some or all of the economic benefits required to settle a provision are expected to be recovered from a third party, the receivable is recognised as an asset if it is virtually certain that reimbursements will be received and the amount of the receivable can be measured reliably.

A restructuring provision is recognised when the ICB has developed a detailed formal plan for the restructuring and has raised a valid expectation in those affected that it will carry out the restructuring by starting to implement the plan or announcing its main features to those affected by it. The measurement of a restructuring provision includes only the direct expenditures arising from the restructuring, which are those amounts that are both necessarily entailed by the restructuring and not associated with on-going activities of the entity.

1.12 Clinical negligence costs

NHS Resolution operates a risk pooling scheme under which the ICB pays an annual contribution to NHS Resolution, which in return settles all clinical negligence claims. The contribution is charged to expenditure. Although NHS Resolution is administratively responsib le for all clinical negligence cases, the legal liability remains with ICB.

1.13 Non-clinical risk pooling

The ICB participates in the Property Expenses Scheme and the Liabilities to Third Parties Scheme. Both are risk pooling schemes under which the ICB pays an annual contribution to the NHS Resolution and, in return, receives assistance with the costs of claims arising. The annual membership contributions, and any excesses payable in respect of particular claims are charged to operating expenses as and when they become due.

1.14 Contingent liabilities and contingent assets

A contingent liability is a possible obligation that arises from past events and whose existence will be confirmed only by the occurrence or non- occurrence of one or more uncertain future events not wholly within the control of the ICB, or a present obligation that is not recognised because it is not probable that a payment will be required to settle the obligation or the amount of the obligation cannot be measured suff iciently reliably.

A contingent liability is disclosed unless the possibility of a payment is remote.

A contingent asset is a possible asset that arises from past events and whose existence will be confirmed by the occurrence or non-occurrence of one or more uncertain future events not wholly within the control of the ICB. A contingent asset is disclosed where an inflow of economic benefits is probable.

Where the time value of money is material, contingent liabilities and contingent assets are disclosed at their present value.

1.15 Financial assets

Financial assets are recognised when the ICB becomes party to the financial instrument contract or, in the case of trade receivables, when the goods or services have been delivered. Financial assets are derecognised when the contractual rights have expired or the asset has been transferred.

Financial assets are classified into the following categories:

- Financial assets at amortised cost;

- Financial assets at fair value through other comprehensive income and;

- Financial assets at fair value through profit and loss.

The classification is determined by the cash flow and business model characteristics of the financial assets, as set out in IFRS 9, and is determined at the time of initial recognition.

1.15.1 Financial assets at amortised cost

Financial assets measured at amortised cost are those held within a business model whose objective is achieved by collecting contractual cash flows and where the cash flows are solely payments of principal and interest. This includes most trade receivables and other simple debt instruments. After initial recognition these financial assets are measured at amortised cost using the effective interest method less any impairment. The effective interest rate is the rate that exactly discounts estimated future cash receipts through the life of the financial asset to the gross carrying amount of the financial asset.

1.15.2 Impairment of financial assets

For all financial assets measured at amortised cost or at fair value through other comprehensive income (except equity instruments designated at fair value through other comprehensive income), lease receivables and contract assets or assets measured at fair value through other comprehensive income, the ICB recognises a loss allowance representing the expected credit losses on the financial asset.

The ICB adopts the simplified approach to impairment in accordance with IFRS 9, and measures the loss allowance for trade rec eivables, lease receivables and contract assets at an amount equal to lifetime expected credit losses. For other financial assets, the loss allowance is measured at an amount equal to lifetime expected credit losses if the credit risk on the financial instrument has increased significantly since initial recognition (stage 2) and otherwise at an amount equal to 12 month expected credit losses (stage 1).

HM Treasury has ruled that central government bodies may not recognise stage 1 or stage 2 impairments against other government departments, their executive agencies, the Bank of England, Exchequer Funds and Exchequer Funds assets where repayment is ensured by primary legislation. The ICB therefore does not recognise loss allowances for stage 1 or stage 2 impairments against these bodies. Additionally Department of Health and Social Care provides a guarantee of last resort against the debts of its arm’s lengths bodies and NHS bodies and the ICB does not recognise allowances for stage 1 or stage 2 impairments against these bodies.

For financial assets that have become credit impaired since initial recognition (stage 3), expected credit losses at the reporting date are measured as the difference between the asset’s gross carrying amount and the present value of the estimated future cash flows discounted at the financial asset’s original effective interest rate. Any adjustment is recognised in profit or loss as an impairment gain or loss.

1.16 Financial liabilities

Financial liabilities are recognised on the statement of financial position when the ICB becomes party to the contractual provisions of the financial instrument or, in the case of trade payables, when the goods or services have been received. Financial liabilities are de-recognised when the liability has been discharged, that is, the liability has been paid or has expired.

1.17 Value Added Tax

Most of the activities of the ICB are outside the scope of VAT and, in general, output tax does not apply and input tax on purchases is not recoverable. Irrecoverable VAT is charged to the relevant expenditure category or included in the capitalised purchase cost of fixed assets. Where output tax is charged or input VAT is recoverable, the amounts are stated net of VAT.

1.18 Losses and special payments

Losses and special payments are items that Parliament would not have contemplated when it agreed funds for the health service or passed legislation. By their nature they are items that ideally should not arise. They are therefore subject to special control procedures compared with the generality of payments. They are divided into different categories, which govern the way that individual cases are handled.

Losses and special payments are charged to the relevant functional headings in expenditure on an accruals basis, including losses which would have been made good through insurance cover had the ICB not been bearing its own risks (with insurance premiums then being include d as normal revenue expenditure).

1.19 Adoption of new standards

No new standards were adopted in the year.

1.20 New and revised IFRS Standards in issue but not yet effective

- IFRS 17 Insurance Contracts – Application required for accounting periods beginning on or after 1 January 2021. Standard is not yet adopted by the FReM which is expected to be April 2025: early adoption is not therefore permitted.

- IFRS 18 Presentation and Disclosure in Financial Statements – The Standard is effective for accounting periods beginning on or after 1 January 2027. The Standard is not yet UK endorsed and not yet adopted by the FReM. Early adoption is not permitted

- IFRS 19 Subsidiaries without Public Accountability: Disclosures – The Standard is effective for accounting periods beginning on or after 1 January 2027. The Standard is not yet UK endorsed and not yet adopted by the FReM. Early adoption is not permitted.

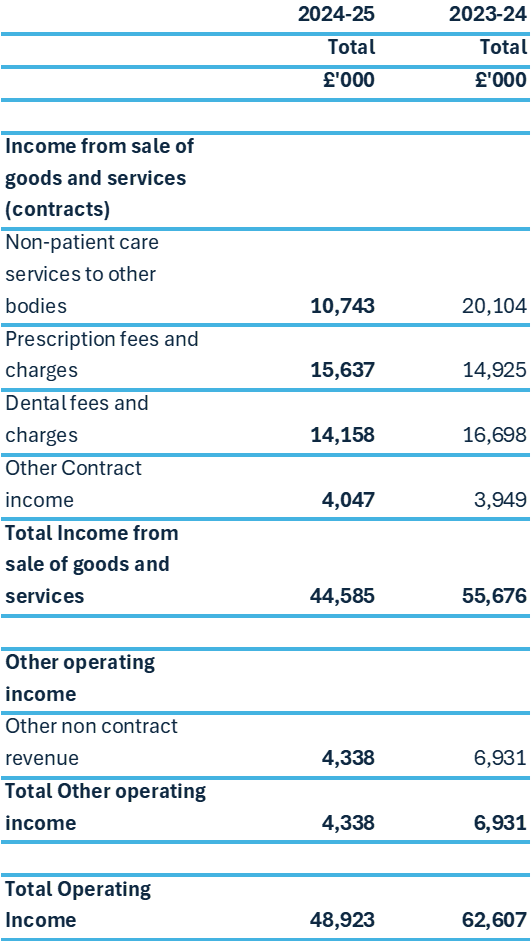

2. Other operating revenue

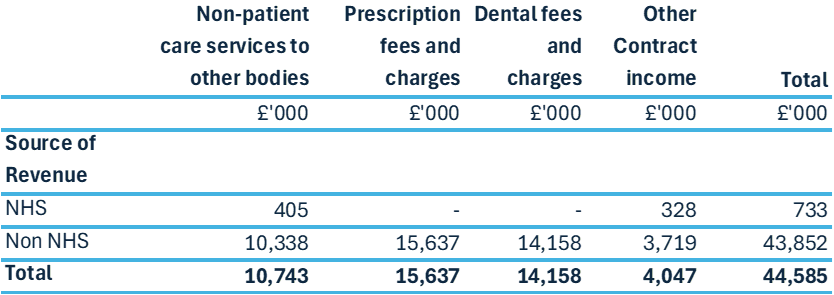

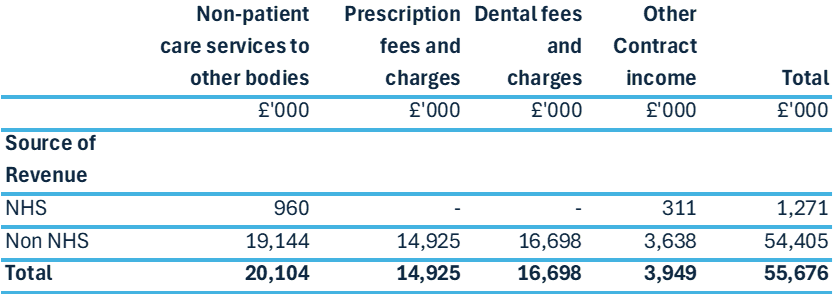

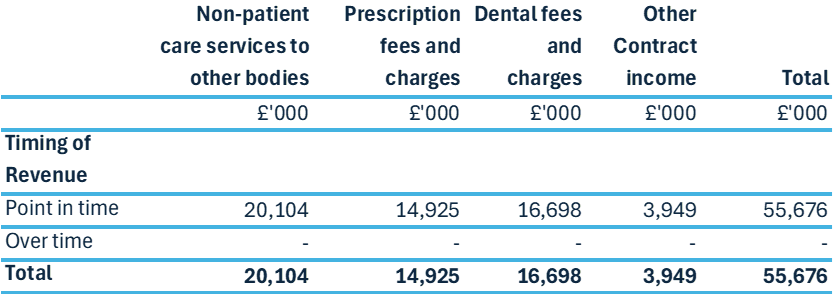

3.1 Disaggregation of income – income from sale of good and services (contracts)

31 March 2025

31 March 2024

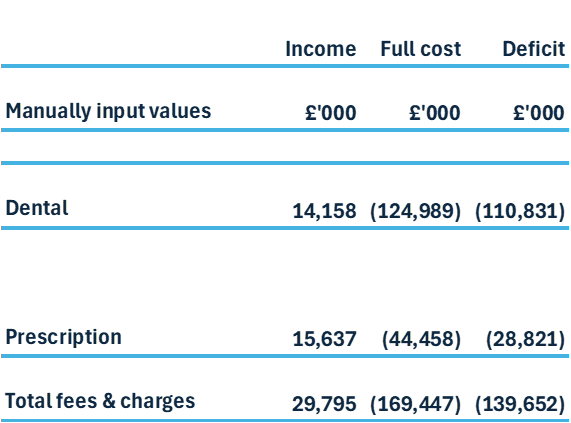

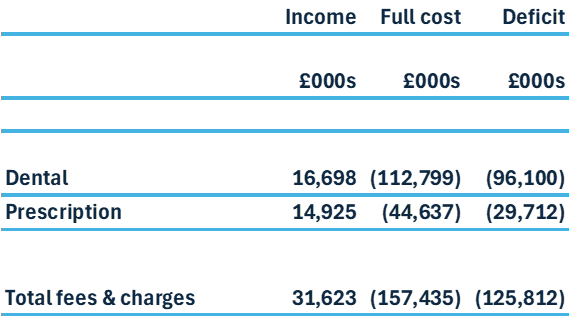

3.2 Cost allocation and setting of dental and prescription charges

31 March 2025

31 March 2024

The fees and charges information in this note is provided in accordance with section 3.2.1 of the Government Financial Reporting Manual. It is provided for fees and charges purposes and not for IFRS 8 purposes. The financial objective of prescription and dental charges is to collect charges only from those patients that are eligible to pay.

Prescription charges are a contribution to the cost of pharmaceutical services including the supply of drugs. In 2024/25, the NHS prescription charge for each medicine or appliance dispensed was £9.90 (2023/24 £9.65). However, around 95% of prescription items are dispensed free each year where patients are exempt from charges. In addition, patients who were eligible to pay charges could purchase pre-payment certificates at £33.05 (2023/24 £31.25) for three months or £114.50 (2023/24 £111.60) for a year. A number of other charges were payable for wigs and fabric supports.

NHS Dental charges are payable for those who are not eligible for exemption, which fall into three bands depending on the level and complexity of care provided. In 2024/25, the charge for Band 1 treatments was £27.40 (2023/24 £25.80), for Band 2 was £75.30 (2023/24 £70.70) and for Band 3 was £326.70 (2023/24 £306.80).

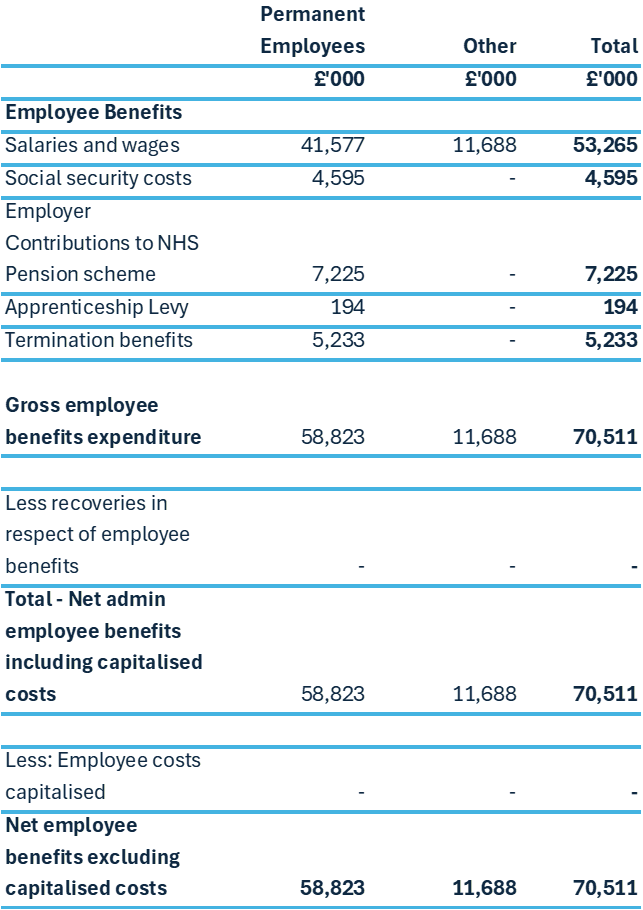

4. Employee benefits and staff numbers

4.1 Employee benefits

2024 to 2025

2023 to 2024

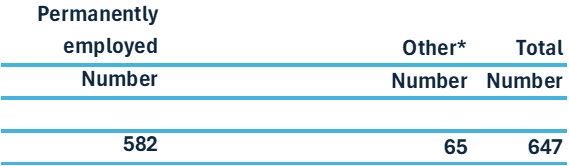

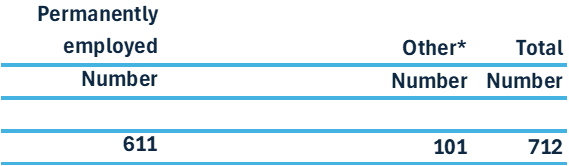

4.2 Average number of people employed

2024 to 2025

2023 to 2024

*Other staff mainly comprises people employed under agency contracts.

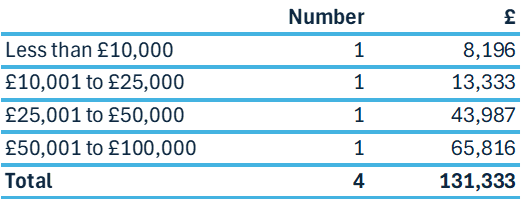

4.3 Exit packages agreed in the financial year

2024 to 2025

Compulsory redundancies

Total redundancies

2023 to 2024

Compulsory redundancies

Total redundancies

The ICB commenced an organisation wide restructure in September 2023 and the process continued through 2024-25. The exit costs incurred are reported in the tables above.

Exit costs are accounted for in accordance with relevant accounting standards and at the latest in full in the year of departure.

The Remuneration Report includes the disclosure of exit payments payable to individuals named in that Report.

4.4 Pension costs

Past and present employees are covered by the provisions of the NHS Pension Schemes. Details of the benefits payable and rules of the schemes can be found on the NHS Pensions website at www.nhsbsa.nhs.uk/pensions. Both the 1995/2008 and 2015 schemes are accounted for, and the scheme liability valued, as a single combined scheme. Both are unfunded defined benefit schemes that cover NHS employers, GP practices and other bodies, allowed under the direction of the Secretary of State for Health and Social Care in England and Wales. They are not designed to be run in a way that would enable NHS bodies to identify their share of the underlying scheme assets and liabilities. Therefore, each scheme is accounted for as if it were a defined contribution scheme: the cost to the NHS body of participating in each scheme is taken as equal to the contributions payable to that scheme for the accounting period.

In order that the defined benefit obligations recognised in the financial statements do not differ materially from those that would be determined at the reporting date by a formal actuarial valuation, the FReM requires that “the period between formal valuations shall be four years, with approximate assessments in intervening years”.

An outline of these follows:

4.4.1 Accounting valuation

A valuation of scheme liability is carried out annually by the scheme actuary (currently the Government Actuary’s Department) as at the end of the reporting period. This utilises an actuarial assessment for the previous accounting period in conjunction with updated

membership and financial data for the current reporting period, and is accepted as providing suitably robust figures for financial reporting purposes. The valuation of the scheme liability as at 31 March 2025, is based on valuation data as at 31 March 2023, updated to 31 March 2025 with summary global member and accounting data. In undertaking this actuarial assessment, the methodology prescribed in IAS 19, relevant FReM interpretations, and the discount rate prescribed by HM Treasury have also been used.

The latest assessment of the liabilities of the scheme is contained in the Statement by the Actuary, which forms part of the annual NHS Pension Scheme Annual Report and Accounts. These accounts can be viewed on the NHS Pensions website and are published

annually. Copies can also be obtained from The Stationery Office.

4.4.2 Full actuarial (funding) valuation

The purpose of this valuation is to assess the level of liability in respect of the benefits due under the schemes (considering recent demographic experience), and to recommend the contribution rate payable by employers.

The latest actuarial valuation undertaken for the NHS Pension Scheme was completed as at 31 March 2020. The results of this valuation set the employer contribution rate payable from 1 April 2024 to 23.7% of pensionable pay. The core cost cap cost of the scheme was

calculated to be outside of the 3% cost cap corridor as at 31 March 2020. However, when the wider economic situation was taken into account through the economic cost cap cost of the scheme, the cost cap corridor was not similarly breached. As a result, there was no

impact on the member benefit structure or contribution rates.

The 2024 actuarial valuation is currently being prepared and will be published before new contribution rates are implemented from April 2027.

NHS South West London ICB participates in NEST, a defined contribution workplace pension scheme. The Trust’s employer contribution rate is 3% of eligible employee earnings. As of 31st March, 4 employees were participating in the scheme. The Trust recognizes its contributions to NEST as an expense in the period they are made, in accordance with IAS 19.

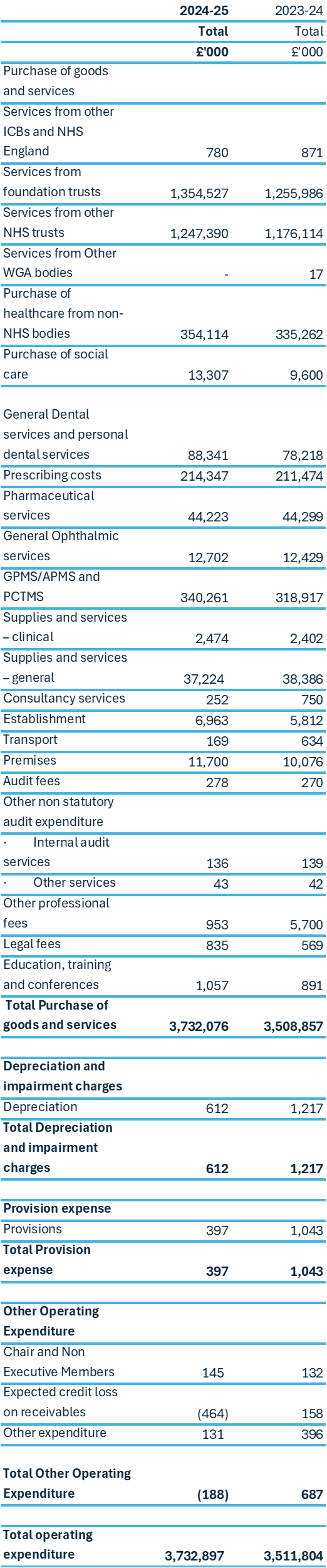

5. Operating expenses

Limitation on auditor’s liability – In accordance with the terms of engagement with the trust’s external auditors, Grant Thornton UK LLP, its members, partners and staff (whether contract, negligence or otherwise) in respect of services provided in connection with or arising out of the audit shall in no circumstances exceed £2million in the aggregate in respect of all such services.

To note that Grant Thornton UK LLP do not provide Internal audit services for the ICB. Audit Fees are £232k exclusive of VAT.

Other services are in respect of the Mental Health Investment Standard Returns and were £36k exclusive of VAT.

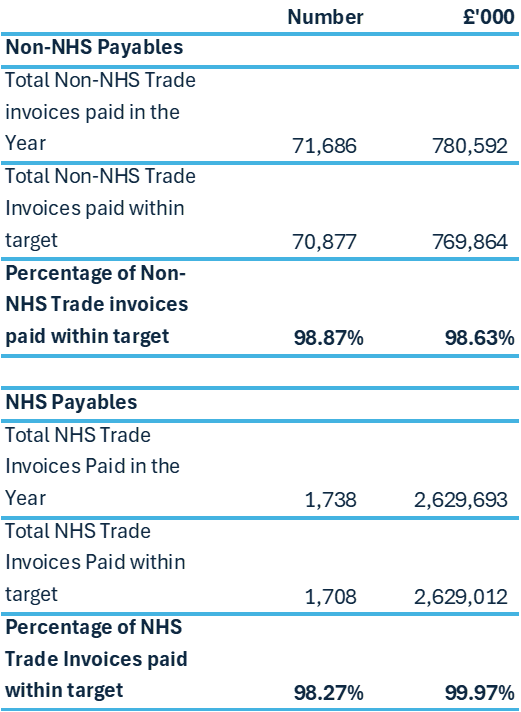

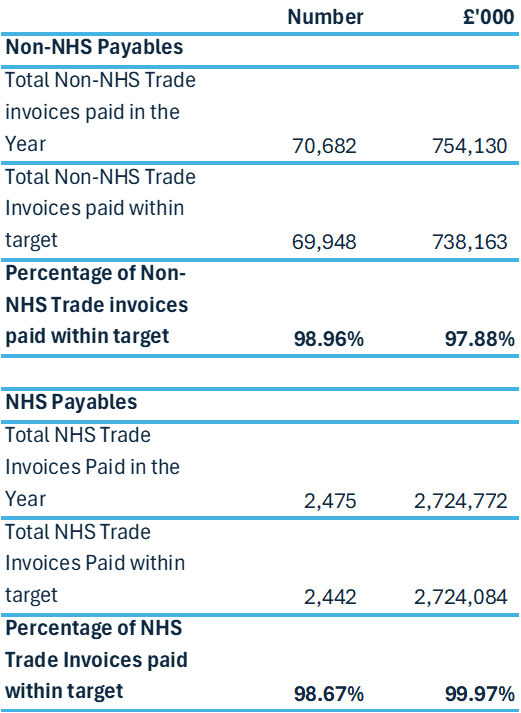

6. Better compliance reporting

6.1 Better payment practice code

2024 to 2025

2023 to 2024

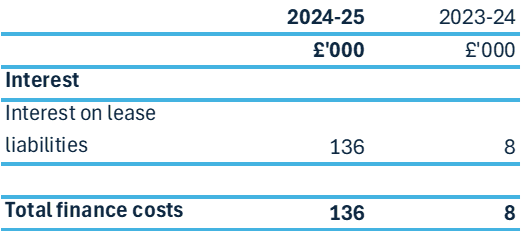

7. Finance costs

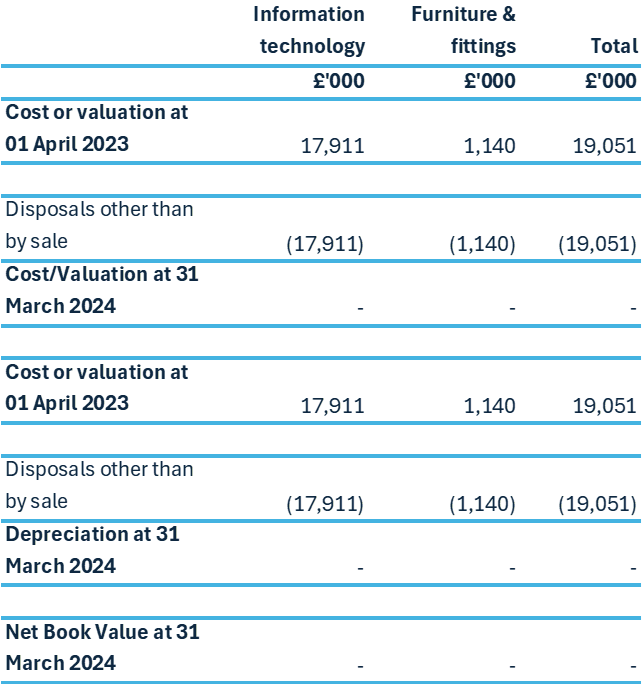

8. Property, plant and equipment

The ICB held no property plant and equipment during 2024-25.

2023 to 2024

On the 1st July 2022, as a result of the demise of NHS LSS and the formation of the new integrated care boards, NHS South West London ICB agreed to take on certain elements of the LSS business and this included the IT assets that it held on its books at that time.

The ICB was tasked with decommissioning the assets. This process to decommission and dispose of the IT assets was concluded in the year to 31st March 2024.

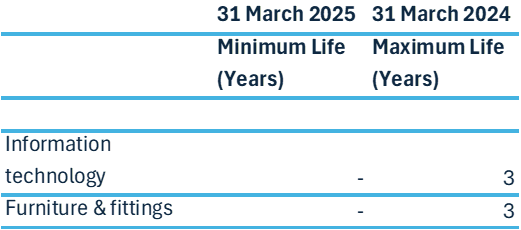

9. Economic lives

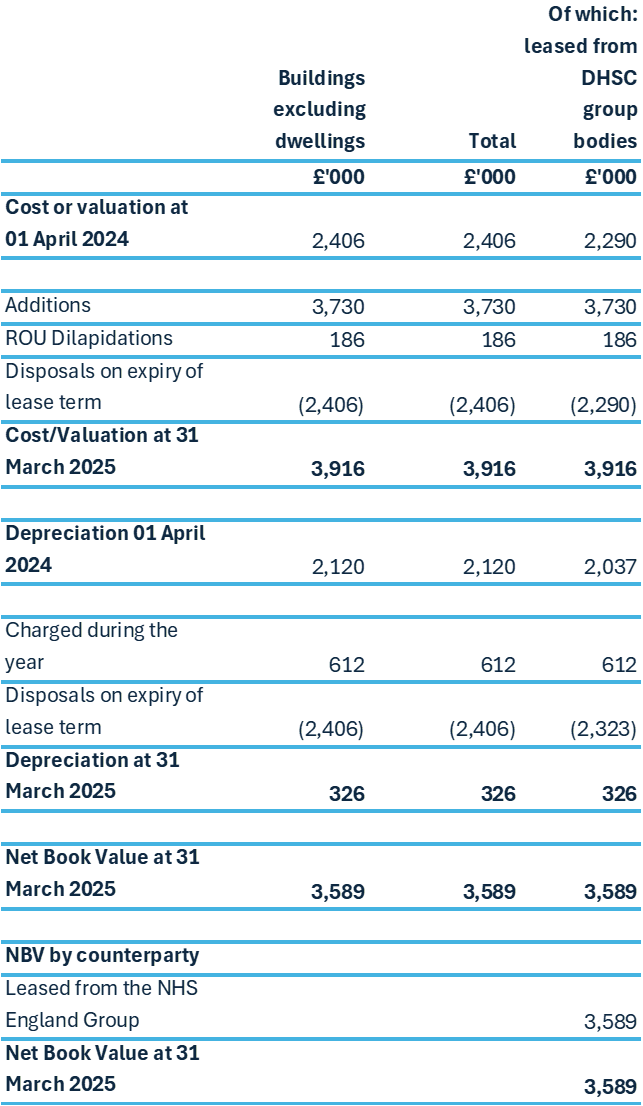

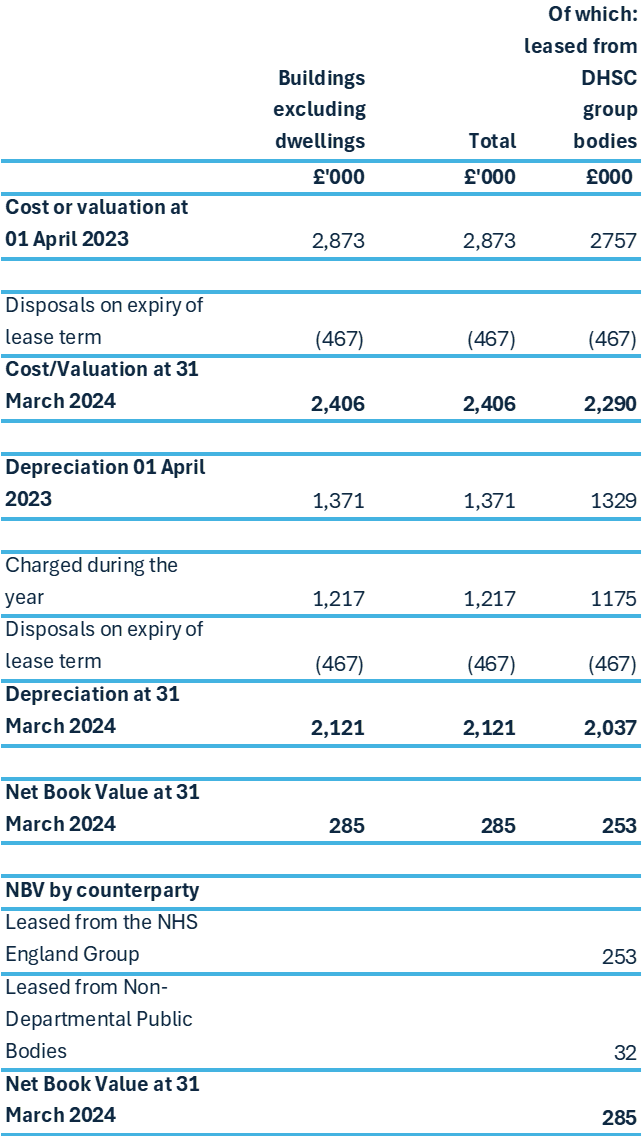

10. Leases

10.1 Right of use assets

2024 to 2025

2023 to 2024

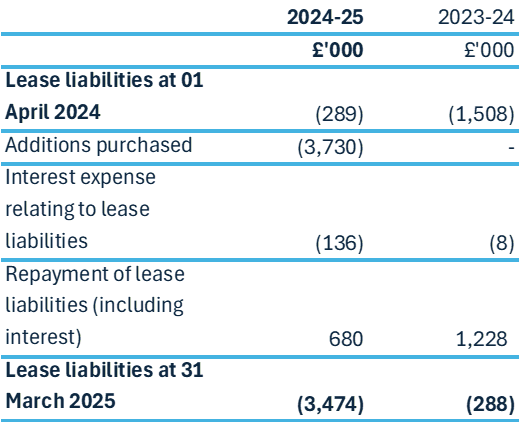

10.2 Lease liabilities

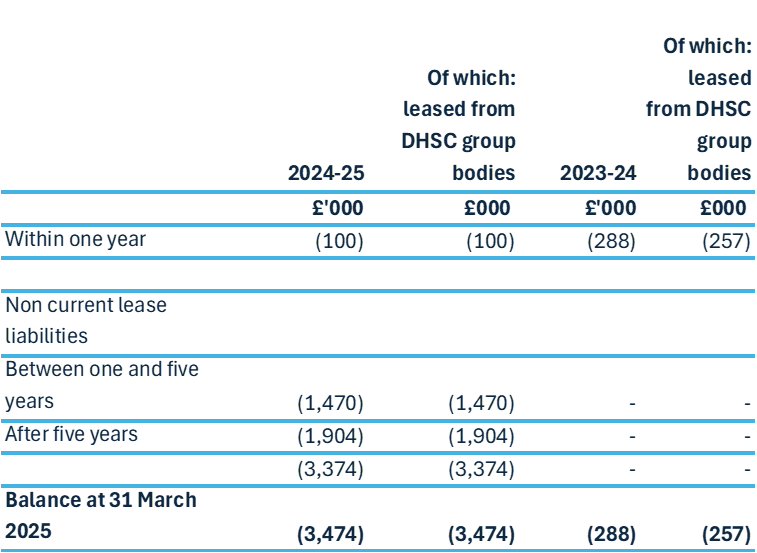

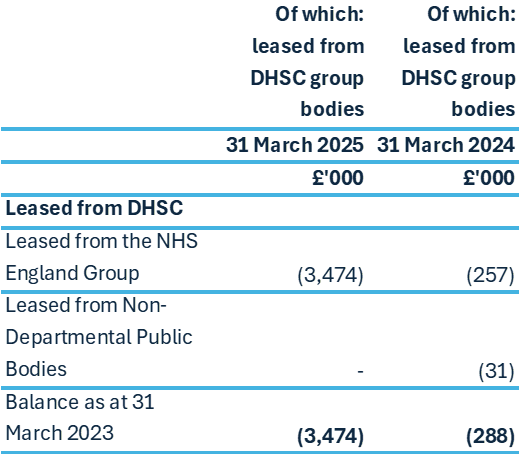

10.3 Lease liabilities – Maturity analysis of undiscounted future lease payments

Current lease liabilities

Balance by counterparty

10.4 Amounts recognised in Statement of Comprehensive Net Expenditure

10.5 Amounts recognised in Statement of Cash Flows

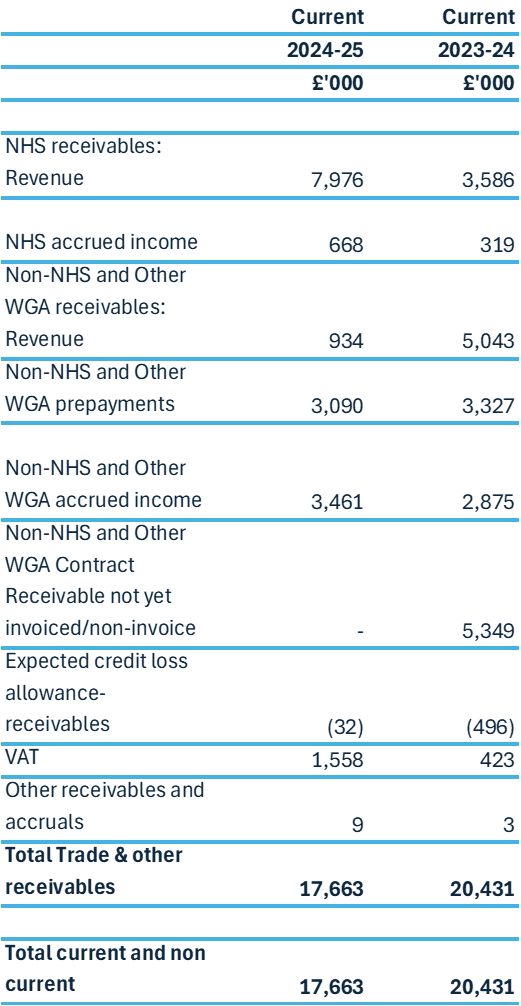

11.1 Trade and other receivables

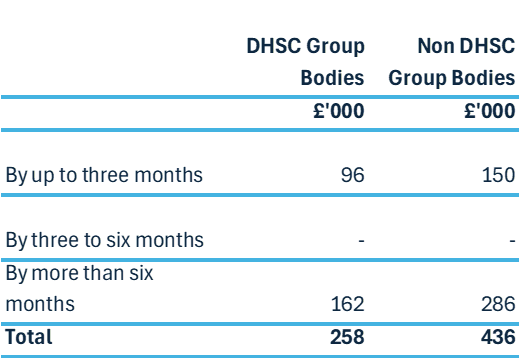

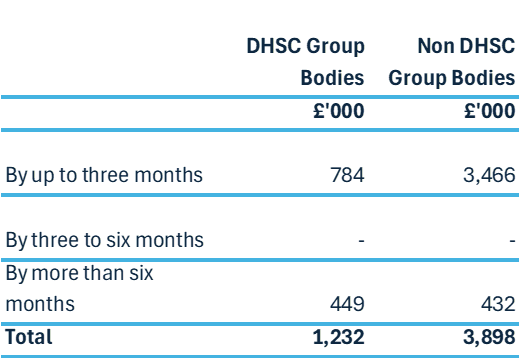

11.2 Receivables past their due date but not impaired

2024 to 2025

2023 to 2024

11.3 Loss allowance on asset classes

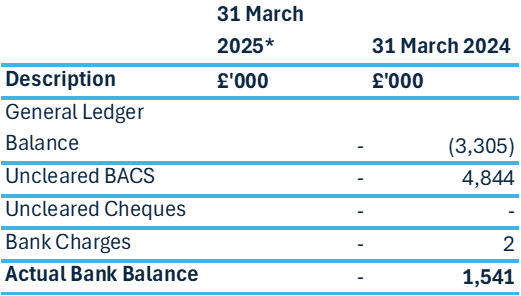

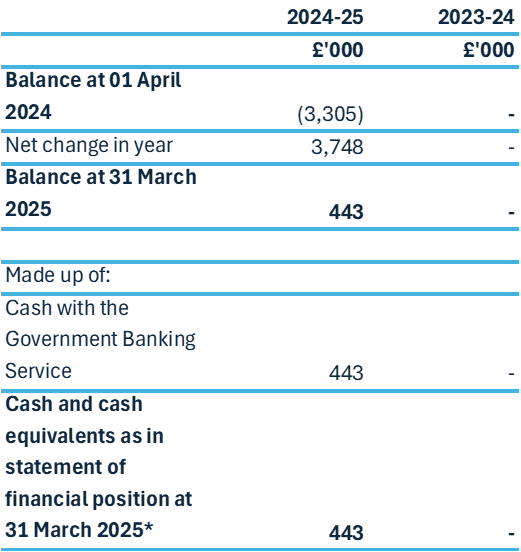

12. Cash and cash equivalents

The comparative position at 31 March 2024 was an overdraft and is reported in note 14 Borrowings.

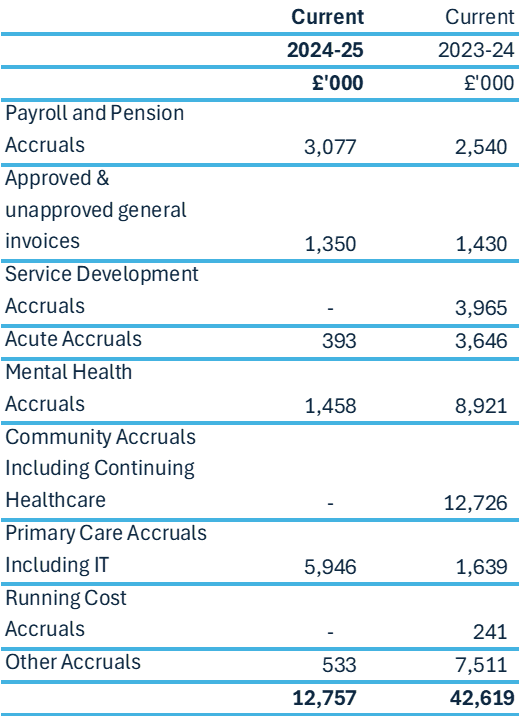

13. Trade and other payables

Other payables include £3,088,677 outstanding pension contributions at 31 March 2025, (£2,556,992 – 31 March 2024)

*Other payables and accruals

14. Borrowings

Repayment of principal falling due

2024 to 2025

2023 to 2024

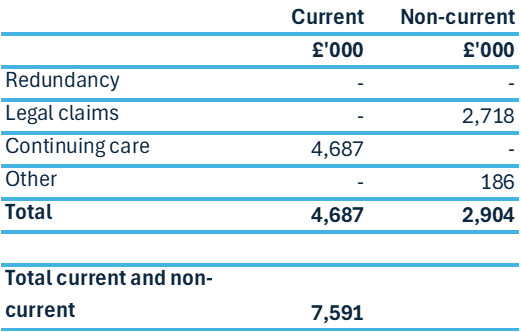

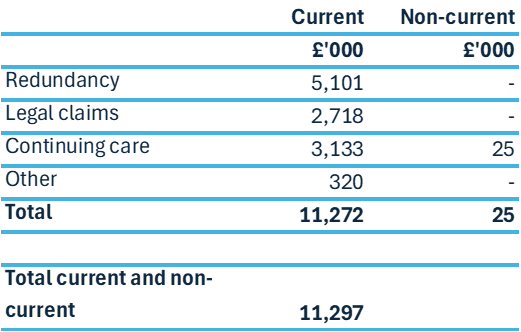

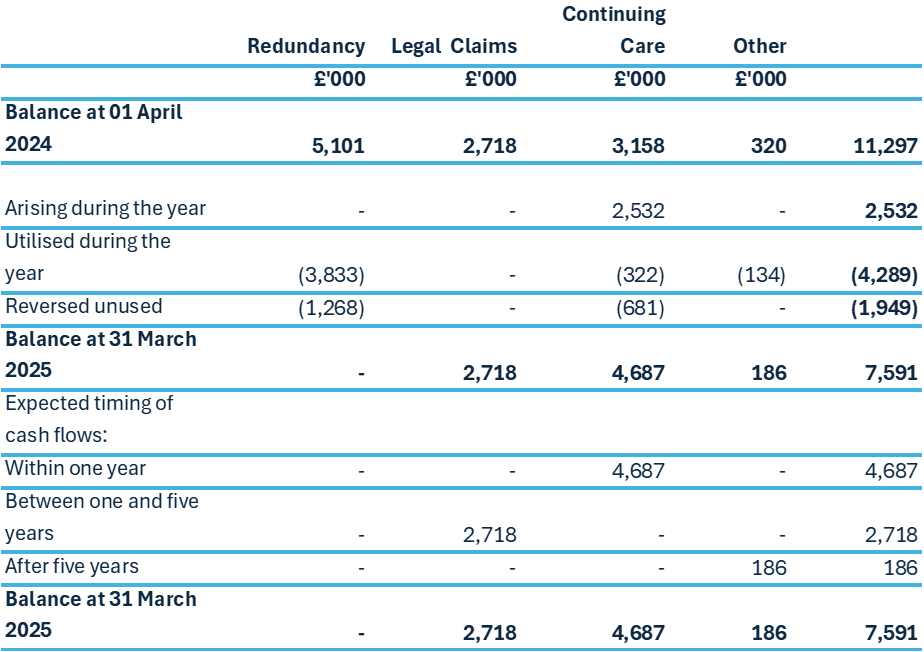

15. Provisions

2024 to 2025

2023 to 2024

The ICB had recognised a redundancy provision in line with IAS 37 for an organisation wide restructure that was undertaken in the year. £1.27m was reversed as unused. The ICB has accrued £0.48m of redundancy costs at 31st March 2025 relating to staff departures that have been agreed but not yet paid.

The legal claims provision relates to potential costs for 453 patients under Liberty Protection Safeguards (LPS). Due to the implementation of the Liberty Protection Safeguards (LPS) being delayed until at least 2025, the ICB has amended the use of provision from less than 1 year to used within 1 to 5 years. Liberty Protection Safeguards (LPS) are replacing the current Deprivation of Liberty Safeguards (DoLS).

The CHC Provision above is made up of 91 restitution claim cases expected to be settled within one year.

Legal claims are calculated from the number of claims currently lodged with NHS Resolution and probabilities provided by them. £0 is included in the provisions of NHS Resolution as at 31st March 2025 in respect of employer liabilities of NHS South West London ICB (2024 – £0)

16. Contingencies

Contingent liabilities

During 2024 a joint procurement was undertaken by NHS South West London ICB with 23 other ICBs for Primary Care Clinical Waste Collection and Disposal for a period of 5 years with the option to extend for a further 4 years. Each ICB procured an individual Lot. In December 2024, 9 of the ICBs published contract notices to award a contract. During the subsequent standstill period in December 2024, legal proceedings challenging the contract awards were commenced by one of the unsuccessful bidders, naming all 22 of the ICBs which remained involved in the Procurement (2 ICBs having decided not to proceed) as Defendants. At this early stage of the Claim, it is not possible to sensibly or accurately determine the probability of success by the Claimant, nor is it possible to estimate the financial impact of a successful Claim with any level of certainty. Given this uncertainty of both of these key components, the ICB is therefore classifying this challenge as a contingent liability.

17. Financial instruments

17.1 Financial risk management

Financial reporting standard IFRS 7 requires disclosure of the role that financial instruments have had during the period in creating or changing the risks a body faces in undertaking its activities.

Because NHS South West London ICB is financed through parliamentary funding, it is not exposed to the degree of financial risk faced by business entities. Also, financial instruments play a much more limited role in creating or changing risk than would be typical of listed companies, to which the financial reporting standards mainly apply. The ICB has limited powers to borrow or invest surplus funds and financial assets and liabilities are generated by day-to-day operational activities rather than being held to change the risks facing the ICB in undertaking its activities.

Treasury management operations are carried out by the finance department, within parameters defined formally within the ICB standing financial instructions and policies agreed by the Board. Treasury activity is subject to review by the ICB and internal auditors.

17.1.1 Currency risk

The ICB is principally a domestic organisation with the great majority of transactions, assets and liabilities being in the UK and sterling based. The ICB has no overseas operations. The ICB therefore has low exposure to currency rate fluctuations.

17.1.2 Interest rate risk

The ICB borrows from government for capital expenditure, subject to affordability as confirmed by NHS England. The borrowings are for 1 to 25 years, in line with the life of the associated assets, and interest is charged at the National Loans Fund rate, fixed for the life of the loan. The ICB therefore has low exposure to interest rate fluctuations.

17.1.3 Credit risk

Because the majority of the ICB funding comes parliamentary funding, the ICB has low exposure to credit risk. The maximum exposures as at the end of the financial year are in receivables from customers, as disclosed in the trade and other receivables note.

17.1.4 Liquidity risk

The ICB is required to operate within revenue and capital resource limits, which are financed from resources voted annually by Parliament. The ICB draws down cash to cover expenditure, as the need arises. The ICB is not, therefore, exposed to significant liquidity risks.

17.1.5 Financial Instruments

As the cash requirements of NHS England are met through the Estimate process, financial instruments play a more limited role in creating and managing risk than would apply to a non-public sector body. The majority of financial instruments relate to contracts to buy non- financial items in line with NHS England’s expected purchase and usage requirements and NHS England is therefore exposed to little credit, liquidity or market risk.

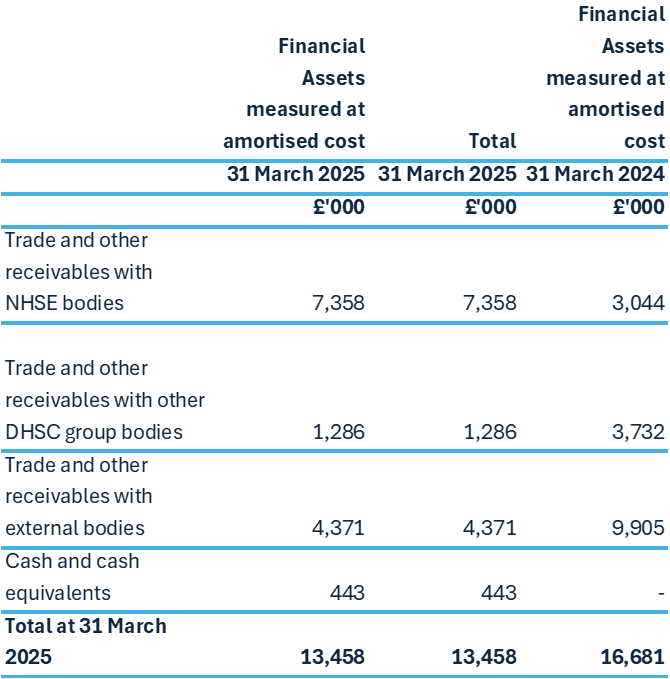

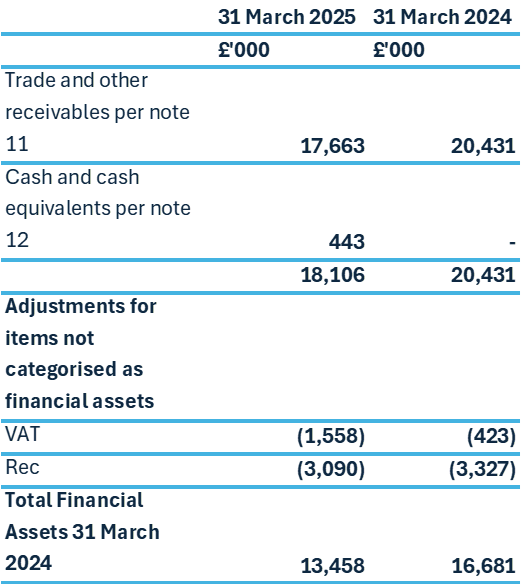

17.2 Financial assets

Financial assets reconciliation

Per IFRS 7 not all trade and other receivables are categorised as financial assets. The reconciliation below shows the receivables not meeting the definition and therefore excluded from the values reported above.

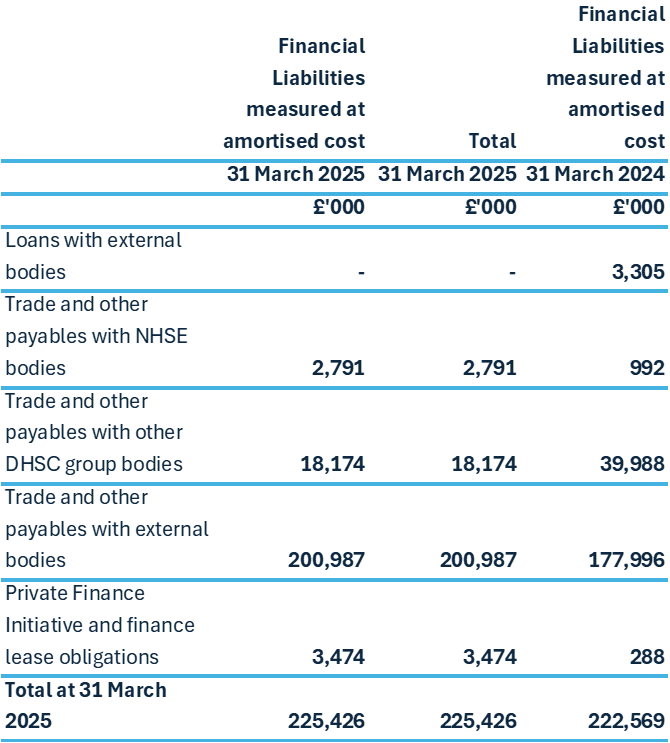

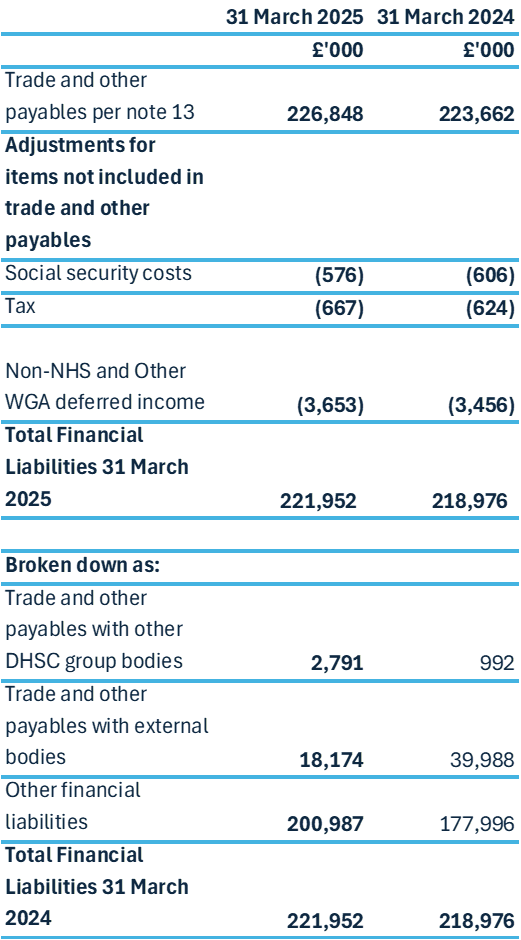

17.3 Financial liabilities

Financial liabilities reconciliation

Per IFRS 7 not all trade and other payables are categorised as financial liabilities. The reconciliation below shows the payables not meeting the definition and therefore excluded from the values reported above.

18. Operating segments

The ICB has just one operating segment which is the commissioning of Healthcare.

19. Joint arrangements – interests in joint operations

South West London ICB hosts a Better Care Fund pooled budget with the London Borough of Croydon. Under these arrangements funds are pooled under section 75 of the NHS Act 2006. NHS South West London ICB contributes to the pool for the services delivered as a provider of healthcare. Members to the BCF pool account for transactions and balances directly with providers. Subject to the requirements of National Guidance and the Better Care Fund plan the agreed risk shareis in the following proportions: ICB 70%; Council 30%.

Royal Borough of Kingston hosts a Better Care Fund pooled budget for the Borough. Under these arrangements funds are pooled under section 75 of the NHS Act 2006. NHS South West London ICB contributes to the pool for the services delivered as a provider of healthcare. Members to the BCF pool account for transactions and balances directly with providers. Partners are solely liable for any overspends to services commissioned exercise of their statutory functions.

London Borough of Merton hosts a Better Care Fund (including community equipment) pooled budget for the Borough. Under these arrangements funds are pooled under section 75 of the NHS Act 2006. NHS South West London ICB contributes to the pool for the services delivered as a provider of healthcare. Members to the BCF pool account for transactions and balances directly with providers. Partners are solely liable for any overspends to services commissioned exercise of their statutory functions.

London Borough of Richmond hosts a Better Care Fund pooled budget for the Borough. Under these arrangements funds are pooled under section 75 of the NHS Act 2006. NHS South West London ICB contributes to the pool for the services delivered as a provider of healthcare. Members to the BCF pool account for transactions and balances directly with providers. Partners are solely liable for any overspends to services commissioned exercise of their statutory functions.

London Borough of Sutton hosts a Better Care Fund pooled budget for the Borough. Under these arrangements funds are pooled under section 75 of the NHS Act 2006. NHS South West London ICB contributes to the pool for the services delivered as a provider of healthcare. Members to the BCF pool account for transactions and balances directly with providers. Under the section 75 financial risk is shared on the basis of the financial contribution to the BCF total fund.

London Borough of Wandsworth hosts a Better Care Fund pooled budget for the Borough. Under these arrangements funds are pooled under section 75 of the NHS Act 2006. NHS South West London ICB contributes to the pool for the services delivered as a provider of healthcare. Members to the BCF pool account for transactions and balances directly with providers. Partners are solely liable for any overspends to services commissioned exercise of their statutory functions.

NHS South West London ICB’s shares of assets/liabilities and income and expenditure handled by the pooled budgets in the financial year were:

2024 to 2025

2023 to 2024

20. Related party transactions

Details of related party transactions with individuals are as follows:

NHS

- St George’s University Hospitals NHS Foundation Trust

- Croydon Health Services NHS Trust

- Epsom & St Helier University Hospitals NHS Trust

- Kingston and Richmond Hospital NHS Foundation Trust *

- South West London & St George’s Mental Health NHS Trust

- Chelsea & Westminster NHS Hospitals Foundation Trust

- London Ambulance Services NHS Trust

- South London and Maudsley NHS Foundation Trust

- The Royal Marsden NHS Foundation Trust

- Guys & St Thomas NHS Foundation Trust

- Houslow and Richmond Community Healthcare NHS Trust

- King’s College Hospital NHS Foundation Trust

- Moorfields Eye Hospital NHS Foundation Trust

Local Authorities

- London Borough of Wandsworth

- London Borough of Croydon

- London Borough Of Sutton

- London Borough of Merton

- Royal Borough of Kingston upon Thames

- London Borough of Richmond upon Thames

Other

- HMRC

- NHS Pensions

The Department of Health and Social Care is regarded as a related party. During the period, NHS South West London ICB has had a significant number of material transactions with NHS entities for which the Department is regarded as the parent Department.

The materiality level set for these transactions is £37m which is 1% of the ICB total operating expenses for the year.

Kingston Hospital NHS Foundation Trust and Hounslow and Richmond Community Healthcare NHS Trust merged on 1st November 2024 to form Kingston and Richmond Hospital NHS Foundation Trust.

The predecessor organisations are not reported separately for the purposes of this note.

21. Disclosure on events after the end of the reporting period

On 13 March 2025 the government announced NHS England and the Department for Health and Social Care will increasingly merge functions, ultimately leading to NHS England being fully integrated into the Department. The legal status of ICBs is currently unchanged but they have been tasked with significant reductions in their cost base.

Discussions are ongoing on the impact of these and the impact of staffing reductions, together with the costs and approvals of any exit arrangements. ICBs are currently being asked to implement any plans during quarter 3 of the 2025/26 financial year.

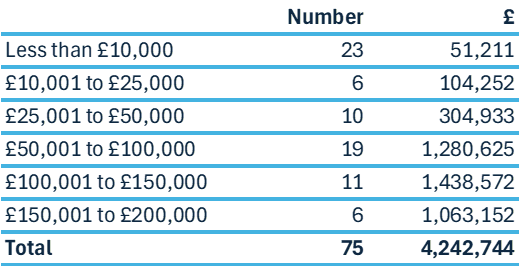

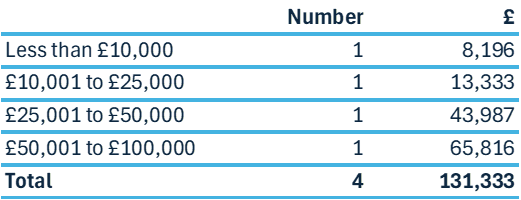

22. Losses and special payments

The 2024 compensation payments relate to settlement of 2 employee claims against NHS South West London ICB.

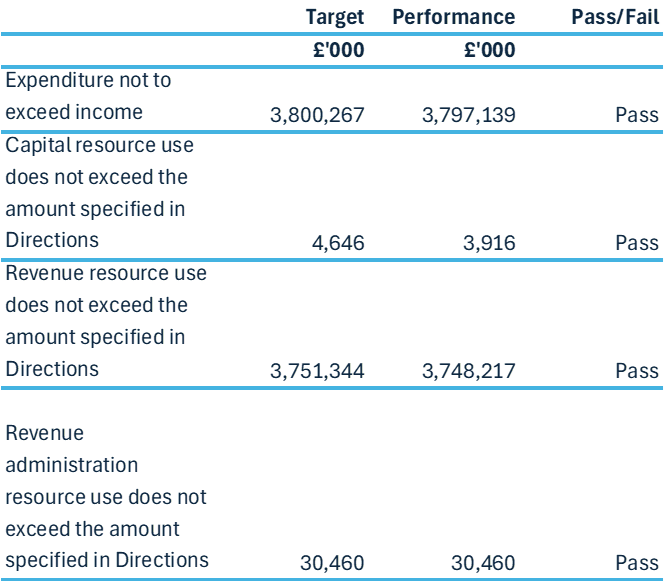

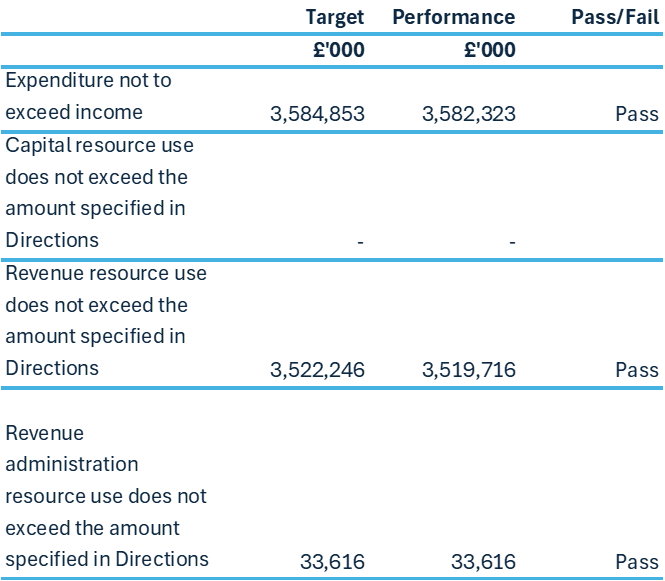

23. Financial performance targets

NHS Integrated Care Boards have a number of financial duties under the NHS Act 2006 (as amended). NHS South West London Integrated Care Board performance against those duties was as follows:

2024 to 2025

2023 to 2024

Independent auditor’s report to the members of the Governing Body of South West London Integrated Care Board

Report on the audit of the financial statements

Opinion on financial statements

We have audited the financial statements of South West London Integrated Care Board (the ‘ICB’) for the year ended 31 March 2025, which comprise the statement of comprehensive net expenditure, the statement of financial position, the statement of changes in tax payers’ equity, the statement of cash flows and notes to the financial statements, including material accounting policy information. The financial reporting framework that has been applied in their preparation is applicable law and international accounting standards in conformity with the requirements of Schedule 1B of the National Health Service Act 2006, as amended by the Health and Care Act 2022 and interpreted and adapted by the Department of Health and Social Care Group Accounting Manual 2024-25.

In our opinion, the financial statements:

- give a true and fair view of the financial position of the ICB as at 31 March 2025 and of its expenditure and income for the year then ended;

- have been properly prepared in accordance with international accounting standards as interpreted and adapted by the Department of Health and Social Care Group Accounting Manual 2024-25; and

- have been prepared in accordance with the requirements of the National Health Service Act 2006, as amended by the Health and Care Act 2022.

Basis for opinion

We conducted our audit in accordance with International Standards on Auditing (UK) (ISAs (UK)) and applicable law, as required by the Code of Audit Practice (2024) (“the Code of Audit Practice”) approved by the Comptroller and Auditor General. Our responsibilities under those standards are further described in the ‘Auditor’s responsibilities for the audit of the financial statements’ section of our report. We are independent of the ICB in accordance with the ethical requirements that are relevant to our audit of the financial statements in the UK, including the FRC’s Ethical Standard, and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Conclusions relating to going concern

We are responsible for concluding on the appropriateness of the Accountable Officer’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty exists related to events or conditions that may cast significant doubt on the ICB’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our report to the related disclosures in the financial statements or, if such disclosures are inadequate, to modify the auditor’s opinion. Our conclusions are based on the audit evidence obtained up to the date of our report. However, future events or conditions may cause the ICB to cease to continue as a going concern.

In our evaluation of the Accountable Officer’s conclusions, and in accordance with the expectation set out within the Department of Health and Social Care Group Accounting Manual 2024-25 that the ICB’s financial statements shall be prepared on a going concern basis, we considered the inherent risks associated with the continuation of services currently provided by the ICB. In doing so we have had regard to the guidance provided in Practice Note 10 Audit of financial statements and regularity of public sector bodies in the United Kingdom (Revised 2024) on the application of ISA (UK) 570 Going Concern to public sector entities. We assessed the reasonableness of the basis of preparation used by the ICB and the ICB’s disclosures over the going concern period.

In auditing the financial statements, we have concluded that the Accountable Officer’s use of the going concern basis of accounting in the preparation of the financial statements is appropriate.

Based on the work we have performed, we have not identified any material uncertainties relating to events or conditions that, individually or collectively, may cast significant doubt on the ICB’s ability to continue as a going concern for a period of at least twelve months from when the financial statements are authorised for issue.

Our responsibilities and the responsibilities of the Accountable Officer with respect to going concern are described in the relevant sections of this report.

Other information

The other information comprises the information included in the annual report, other than the financial statements and our auditor’s report thereon. The Accountable Officer is responsible for the other information contained within the annual report. Our opinion on the financial statements does not cover the other information and, except to the extent otherwise explicitly stated in our report, we do not express any form of assurance conclusion thereon.

Our responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the financial statements or our knowledge obtained in the audit or otherwise appears to be materially misstated. If we identify such material inconsistencies or apparent material misstatements, we are required to determine whether there is a material misstatement in the financial statements themselves. If, based on the work we have performed, we conclude that there is a material misstatement of this other information, we are required to report that fact.

We have nothing to report in this regard.

Other information we are required to report on by exception under the Code of Audit Practice

Under the Code of Audit Practice published by the National Audit Office in November 2024 on behalf of the Comptroller and Auditor General (the Code of Audit Practice) we are required to consider whether the Governance Statement does not comply with the requirements of the Department of Health and Social Care Group Accounting Manual 2024-25 or is misleading or inconsistent with the information of which we are aware from our audit. We are not required to consider whether the Governance Statement addresses all risks and controls or that risks are satisfactorily addressed by internal controls.

We have nothing to report in this regard.

Opinion on other matters required by the Code of Audit Practice

In our opinion:

- the parts of the Remuneration and Staff Report to be audited have been properly prepared in accordance with the requirements of the Department of Health and Social Care Group Accounting Manual 2024-25; and

- based on the work undertaken in the course of the audit of the financial statements, the other information published together with the financial statements in the annual report for the period for which the financial statements are prepared is consistent with the financial statements.

Opinion on regularity of income and expenditure required by the Code of Audit Practice

In our opinion, in all material respects the expenditure and income recorded in the financial statements have been applied to the purposes intended by Parliament and the financial transactions in the financial statements conform to the authorities which govern them.

Matters on which we are required to report by exception

Under the Code of Audit Practice, we are required to report to you if:

- we issue a report in the public interest under Section 24 of the Local Audit and Accountability Act 2014 in the course of, or at the conclusion of the audit; or

- we refer a matter to the Secretary of State under Section 30 of the Local Audit and Accountability Act 2014 because we have reason to believe that the ICB, or an officer of the ICB, is about to make, or has made, a decision which involves or would involve the body incurring unlawful expenditure, or is about to take, or has begun to take a course of action which, if followed to its conclusion, would be unlawful and likely to cause a loss or deficiency; or

- we make a written recommendation to the ICB under Section 24 of the Local Audit and Accountability Act 2014 in the course of, or at the conclusion of the audit.

We have nothing to report in respect of the above matters.

Responsibilities of the Accountable Officer

As explained more fully in the Statement of Accountable Officer’s responsibilities, the Accountable Officer, is responsible for the preparation of the financial statements in the form and on the basis set out in the Accounts Directions, for being satisfied that they give a true and fair view, and for such internal control as the Accountable Officer determines is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, the Accountable Officer is responsible for assessing the ICB’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless they have been informed by the relevant national body of the intention to dissolve the ICB without the transfer of its services to another public sector entity.

The Accountable Officer is responsible for ensuring the regularity of expenditure and income in the financial statements.

Auditor’s responsibilities for the audit of the financial statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not a guarantee that an audit conducted in accordance with ISAs (UK) will always detect a material misstatement when it exists.

We are also responsible for giving an opinion on the regularity of expenditure and income in the financial statements in accordance with the Code of Audit Practice.

Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements.

Irregularities, including fraud, are instances of non-compliance with laws and regulations. The extent to which our procedures are capable of detecting irregularities, including fraud is detailed below:

- We obtained an understanding of the legal and regulatory frameworks that are applicable to the ICB and determined that the most significant which are directly relevant to specific assertions in the financial statements are those related to the reporting frameworks (international accounting standards and the National Health Service Act 2006, as amended by the Health and Care Act 2022 and interpreted and adapted by the Department of Health and Social Care Group Accounting Manual 2024-25).

- In addition, we concluded that there are certain significant laws and regulations that may have an effect on the determination of the amounts and disclosures in the financial statements and those laws and regulations relating to international accounting standards and the National Health Service Act 2006, as amended by the Health and Care Act 2022 and interpreted and adapted by the Department of Health and Social Care Group Accounting Manual 2024/25.

- We enquired of management and the audit & risk committee, concerning the ICB’s policies and procedures relating to:

- the identification, evaluation and compliance with laws and regulations;

- the detection and response to the risks of fraud; and

- the establishment of internal controls to mitigate risks related to fraud or non-compliance with laws and regulations.

- We enquired of management, internal audit and the audit & risk committee, whether they were aware of any instances of non-compliance with laws and regulations or whether they had any knowledge of actual, suspected or alleged fraud.

- We assessed the susceptibility of the ICB’s financial statements to material misstatement, including how fraud might occur, evaluating management’s incentives and opportunities for manipulation of the financial statements. This included the evaluation of the risk of management override of controls and any other fraud risks identified for the audit. We determined that the principal risks were in relation to high-risk journals, fraudulent expenditure recognition (and associated payables).

- We determined that the principal risks were in relation to:

- High risk journals which were identified based on consideration of closing entries, entries posted after year end, manual journals and journals that have a material impact on reported outturn along with several other risk factors. We considered whether there was any potential management bias in accounting estimates or any significant transactions with related parties which could give rise to an indication of management override; and

- expenditure recognition, and associated payables and accruals, given the continued financial challenges of the sector and requirement to meet financial targets

- Our audit procedures involved:

- evaluation of the design effectiveness of controls that management has in place to prevent and detect fraud;

- journal entry testing, on unusual journal entries using criteria based on our knowledge of the entity and the risk factors identified;

- challenging assumptions and judgements made by management in its significant accounting estimates in respect of prescribing accruals;

- assessing the extent of compliance with the relevant laws and regulations as part of our procedures on the related financial statement item.

- These audit procedures were designed to provide reasonable assurance that the financial statements were free from fraud or error. The risk of not detecting a material misstatement due to fraud is higher than the risk of not detecting one resulting from error and detecting irregularities that result from fraud is inherently more difficult than detecting those that result from error, as fraud may involve collusion, deliberate concealment, forgery or intentional misrepresentations. Also, the further removed non-compliance with laws and regulations is from events and transactions reflected in the financial statements, the less likely we would become aware of it.

- We communicated relevant laws and regulations and potential fraud risks to all engagement team members, including the potential for fraud in expenditure recognition and associated payables, and related to management override of controls through processing journal entries. We remained alert to any indications of non-compliance with laws and regulations, including fraud, throughout the audit.

- The engagement partner’s assessment of the appropriateness of the collective competence and capabilities of the engagement team included consideration of the engagement team’s:

- understanding of, and practical experience with audit engagements of a similar nature and complexity through appropriate training and participation

- knowledge of the health sector and economy in which the ICB operates

- understanding of the legal and regulatory requirements specific to the ICB including:

- the provisions of the applicable legislation

- NHS England’s rules and related guidance

- the applicable statutory provisions.

- In assessing the potential risks of material misstatement, we obtained an understanding of:

- The ICB’s operations, including the nature of its other operating revenue and expenditure and its services and of its objectives and strategies to understand the classes of transactions, account balances, expected financial statement disclosures and business risks that may result in risks of material misstatement.

- The ICB’s control environment, including the policies and procedures implemented by the ICB to ensure compliance with the requirements of the financial reporting framework.

A further description of our responsibilities for the audit of the financial statements is located on the Financial Reporting

Council’s website at: www.frc.org.uk/auditorsresponsibilities. This description forms part of our auditor’s report.

Report on other legal and regulatory requirements – the ICB’s arrangements for securing economy, efficiency and effectiveness in its use of resources

Matter on which we are required to report by exception – the ICB’s arrangements for securing economy, efficiency and effectiveness in its use of resources

Under the Code of Audit Practice, we are required to report to you if, in our opinion, we have not been able to satisfy ourselves that the ICB has made proper arrangements for securing economy, efficiency and effectiveness in its use of resources for the year ended 31 March 2025.

We have nothing to report in respect of the above matter.

Responsibilities of the Accountable Officer

As explained in the Governance Statement, the Accountable Officer is responsible for putting in place proper arrangements for securing economy, efficiency and effectiveness in the use of the ICB’s resources.

Auditor’s responsibilities for the review of the ICB’s arrangements for securing economy, efficiency and effectiveness in its use of resources

We are required under Section 21(1)(c) of the Local Audit and Accountability Act 2014 to be satisfied that the ICB has made proper arrangements for securing economy, efficiency and effectiveness in its use of resources. We are not required to consider, nor have we considered, whether all aspects of the ICB’s arrangements for securing economy, efficiency and effectiveness in its use of resources are operating effectively.

We have undertaken our review in accordance with the Code of Audit Practice, having regard to the guidance issued by the Comptroller and Auditor General in November 2024. This guidance sets out the arrangements that fall within the scope of ‘proper arrangements’. When reporting on these arrangements, the Code of Audit Practice requires auditors to structure their commentary on arrangements under three specified reporting criteria:

- Financial sustainability: how the ICB plans and manages its resources to ensure it can continue to deliver its services;

- Governance: how the ICB ensures that it makes informed decisions and properly manages its risks; and

- Improving economy, efficiency and effectiveness: how the ICB uses information about its costs and performance to improve the way it manages and delivers its services.

We have documented our understanding of the arrangements the ICB has in place for each of these three specified reporting criteria, gathering sufficient evidence to support our risk assessment and commentary in our Auditor’s Annual Report. In undertaking our work, we have considered whether there is evidence to suggest that there are significant weaknesses in arrangements.

Report on other legal and regulatory requirements – delay in certification of completion of the audit

We cannot formally conclude the audit and issue an audit certificate for South West London Integrated Care Board for the year ended 31 March 2025 in accordance with the requirements of the Local Audit and Accountability Act 2014 and the Code of Audit Practice until we have received confirmation from the National Audit Office that the audit of the NHS group consolidation is complete for the year ended 31 March 2025. We are satisfied that this work does not have a material effect on the financial statements for the year ended 31 March 2025.

Use of our report

This report is made solely to the members of the Governing Body of the ICB, as a body, in accordance with Part 5 of the Local Audit and Accountability Act 2014. Our audit work has been undertaken so that we might state to the members of the Governing Body of the ICB those matters we are required to state to them in an auditor’s report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the ICB and the members of the Governing Body of the ICB as a body, for our audit work, for this report, or for the opinions we have formed.

Joanne Brown, Key Audit Partner

for and on behalf of Grant Thornton UK LLP

London

18 June 2025

Independent auditor’s report to the members of the Governing Body of South West London Integrated Care Board (Audit completion)

Audit completion

In our auditor’s report, issued on 18 June 2025, for South West London Integrated Care Board (the ‘ICB’) for the year ended 31 March 2025, we reported an unqualified opinion on the ICB’s financial statements.

We explained that we could not formally conclude the audit and issue an audit certificate for the ICB for the year ended 31 March 2025, in accordance with the requirements of the Local Audit and Accountability Act 2014 and the Code of Audit Practice, until we had received confirmation from the National Audit Office (NAO) that the audit of the NHS group consolidation is complete for the year ended 31 March 2025. The NAO has confirmed the audit of the NHS group consolidation is complete for the year ended 31 March 2025. We are therefore satisfied all audit work necessary has been completed.

Report on other legal and regulatory requirements – the ICB’s arrangements for securing economy, efficiency and effectiveness in its use of resources

Under the Code of Audit Practice, we are required to report to you if, in our opinion, we have not been able to satisfy ourselves that the ICB has made proper arrangements for securing economy, efficiency and effectiveness in its use of resources for the year ended 31 March 2025.

In our auditor’s report for the year ended 31 March 2025 issued on 18 June 2025 we reported that we have nothing to report in respect of whether the ICB has made proper arrangements for securing economy, efficiency and effectiveness in its use of resources for the year ended 31 March 2025.

No matters have come to our attention since that date that would have resulted in any additional exception reporting on the ICB’s arrangements for securing economy, efficiency and effectiveness in its use of resources for the year ended 31 March 2025.

Report on other legal and regulatory requirements – audit certificate

We certify that we have completed the audit of South West London Integrated Care Board for the year ended 31 March 2025 in accordance with the requirements of the Local Audit and Accountability Act 2014 and the Code of Audit Practice.

Use of our report

This report is made solely to the members of the Governing Body of the ICB, as a body, in accordance with Part 5 of the Local Audit and Accountability Act 2014. Our audit work has been undertaken so that we might state to the members of the Governing Body of the ICB those matters we are required to state to them in an auditor’s report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the ICB and the members of the Governing Body of the ICB, as a body, for our audit work, for this report, or for the opinions we have formed.

Joanne Brown, Key Audit Partner

for and behalf of Grant Thornton UK LLP, Local Auditor

London

16 December 2025

Continue reading the annual report: